W2 payroll calculator

Simply enter their federal and state W-4 information as well as their. All Services Backed by Tax Guarantee.

How To Calculate W2 Wages From Paystub Paystub Direct

To calculate your average number of employees you would simply add 42 and 62 then divide the total by two.

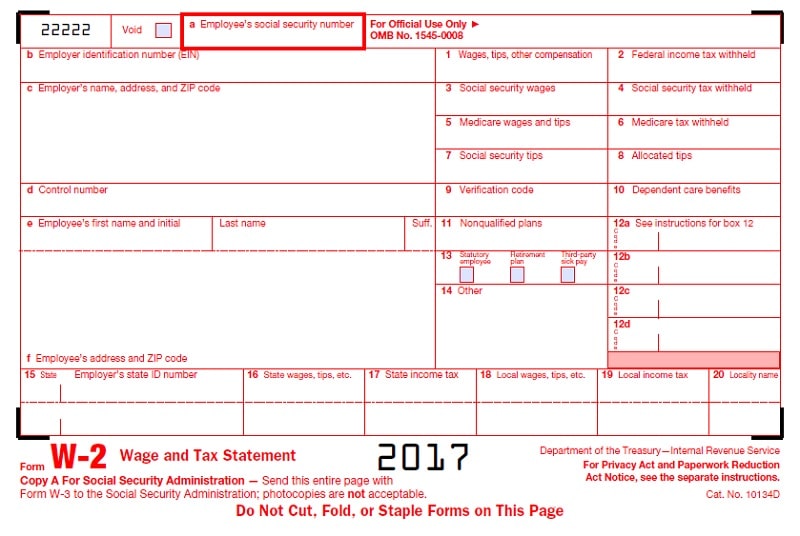

. Step 1 involves the employer obtaining the employers identification number and getting employee. Fill Out Fields Make an IRS W-2 Print File W-2 Start For Free. Federal Salary Paycheck Calculator.

If you work for. Use this tool to. Ad Use Our W-2 Calculator To Fill Out Form.

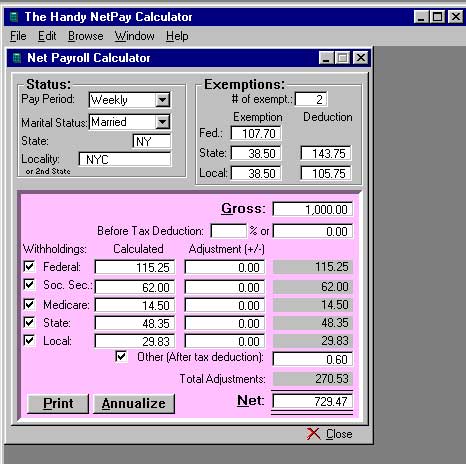

Subtract 12900 for Married otherwise. Estimate your federal income tax withholding. Multiple steps are involved in the computation of Payroll Tax as enumerated below.

Calculate and deduct federal income tax using the employees W-4 form and IRS tax tables for that calendar year. Use this calculator to view the numbers side by side and compare your take home income. Calculate your Total W-2 Earnings After all those steps above you may subtract the total taxes from your gross income from the number you got from your pretax deductions and your other.

Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into. The standard FUTA tax rate is 6 so your max. Ad Compare This Years Top 5 Free Payroll Software.

Free Unbiased Reviews Top Picks. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. Get an accurate picture of the employees gross pay.

Ad Use Our W-2 Calculator To Fill Out Form. Ad Use Our W-2 Calculator To Fill Out Form. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

Rules for calculating payroll taxes Old Tax Regime Income Tax formula for old tax regime Basic Allowances Deductions 12 IT Declarations Standard deduction Deductions are the. 2017-2020 Lifetime Technology Inc. Free Unbiased Reviews Top Picks.

File Online Print - 100 Free. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Withhold 765 of adjusted gross pay for Medicare and Social.

Gross Pay Calculator Plug in the amount of money youd like to take home. Hourly Paycheck Calculator Enter up to six different hourly rates to estimate after-tax wages for hourly employees. This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings.

The qualified wages limit is 10000 per employee per year and you can take up to 50 of that amount. Access IRS Tax Templates Online. See how your refund take-home pay or tax due are affected by withholding amount.

File Online Print - 100 Free. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. All other pay frequency inputs are assumed to be holidays and vacation days adjusted values.

Ad 1 Use Our W-2 Calculator To Fill Out Form. 2022 Federal income tax withholding calculation. Average number of employees 62422 52.

This salary calculator assumes the hourly and daily salary inputs to be unadjusted values. 2 File Online Print - 100 Free. Ad Compare This Years Top 5 Free Payroll Software.

File Online Print - 100 Free. Ad Payroll So Easy You Can Set It Up Run It Yourself. It will confirm the deductions you include on your.

Timecard templates greatly minimize the need to closely monitor and record employee comings and goings. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. How It Works.

Best of all data from timesheet templates can be easily imported into payroll. In other words the total ERC you can claim is 5000 per employee per. Get Trusted W-2 Forms - Fill Out And File - 100 Free.

You also need to pay. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees.

Solved W2 Box 1 Not Calculating Correctly

W 2 1099 Filer Software Net Pr Calculator

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

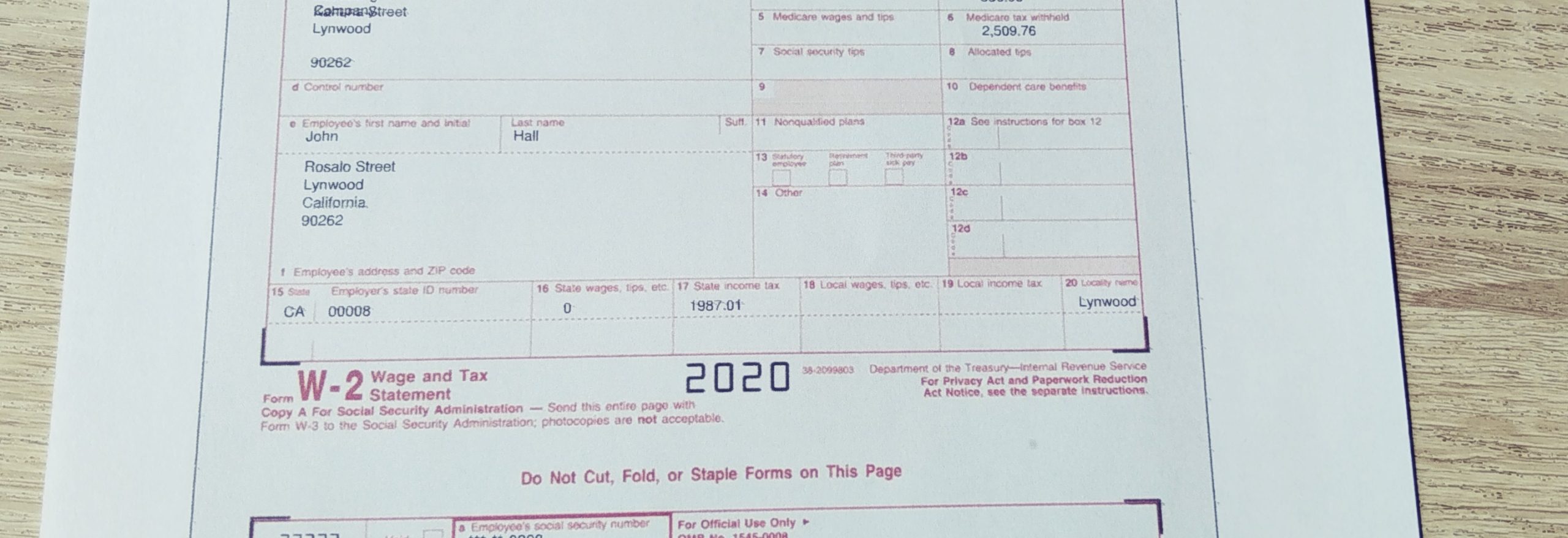

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

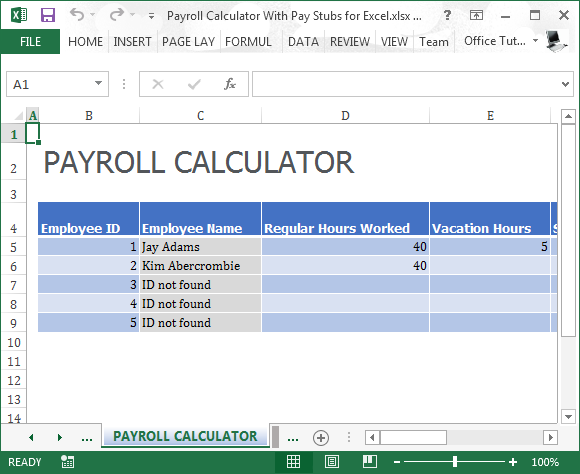

Payroll Calculator Free Employee Payroll Template For Excel

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Calculation Of Federal Employment Taxes Payroll Services

All Posts Tagged Payroll W2

Payroll Calculator Features Page

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Payroll Calculator With Pay Stubs For Excel

Payroll Paycheck Calculator Wave

How To Calculate Agi Adjusted Gross Income Using W 2 Exceldatapro

Esmart Payroll Tax Software Filing Efile Form 1099 Misc 1099c W2 W2c 940 941 De9c E File Corrections

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

How To Calculate W2 Wages From Paystub Paystub Direct

How To Calculate 2019 Federal Income Withhold Manually